what if i need to file a medical claim between end of coverage and cobra

Every bit long as y'all're not in a land that has its own penalty for people who go without minimum essential coverage, you're gratis to buy a plan that's not compliant with the ACA. | Image: kues1 / stock.adobe.com

Q. What happens if I don't purchase ACA-compliant health insurance?

A. Information technology depends on where you live and what medical care y'all end upward needing during the year. But it'due south also important to understand that if you don't buy ACA-compliant health insurance, yous're potentially missing out on the fiscal assistance that's available to most marketplace enrollees.

And the subsidies are larger and more widely available in 2021 and 2022, thank you to the American Rescue Program. Many enrollees will find that they can qualify for gratis or very low-cost coverage with robust benefits, but this opportunity is lost if yous don't shop for coverage in your state's health insurance marketplace (where all of the bachelor plans are ACA-compliant).

If I don't buy an ACA-compliant programme, volition I accept to pay a penalty?

The Affordable Care Act'south individual mandate penalisation was reduced to $0 every bit of 2019, so at that place is no longer a federal penalty for non having minimum essential health coverage.

Merely unless you qualify for an exemption, there is a penalty for beingness without minimum essential coverage if you lot live in California, Rhode Island, Massachusetts, New Jersey, or the Commune of Columbia. Yous don't necessarily need ACA-compliant coverage in society to avoid the penalty in those states, and in that location are some types of minimum essential coverage that aren't ACA-compliant (for example, grandmothered and grandfathered health plans are not fully ACA-compliant, and yet they count as minimum essential coverage). But an ACA-compliant programme is going to give yous the nearly robust coverage.

If my plan is non ACA-compliant, how will my benefits differ?

All ACA-compliant plans in the individual and modest group markets are required to embrace the ACA'south essential health benefits without any caps on the total amount that the plan spends on your intendance. So they'll provide a solid safety internet if you stop up needing significant medical care (although ACA-compliant large group plans are not required to embrace the essential health benefits, most do and then voluntarily in an attempt to concenter and retain employees). And all ACA-compliant plans are required to cover pre-existing weather without whatever waiting periods.

But if you purchase a programme that's not ACA-compliant, the insurer volition be likely to use medical underwriting to adjust the premiums or the coverage based on your medical history, and the programme won't have to encompass the essential wellness benefits unless the country has its own requirements (Idaho'southward enhanced short-term health plans, for example, are not fully compliant with the ACA, but are required to cover the essential health benefits).

What health insurance plans are not considered ACA-compliant?

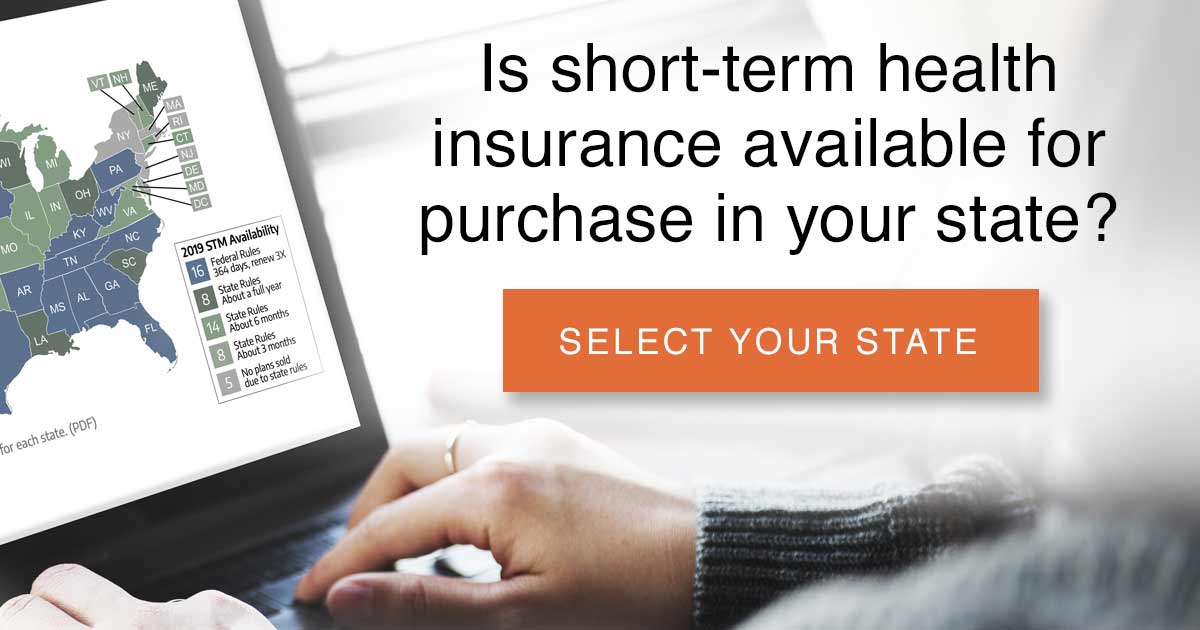

If you're purchasing your ain coverage, in that location is a broad range of health insurance plans that aren't required to comply with the ACA's rules. These include short-term health insurance, Farm Bureau plans in Iowa, Indiana, Tennessee, and Kansas (and soon, South Dakota), travel insurance, accident supplements, limited benefit plans, fixed indemnity plans, and other supplemental or limited coverage.

As long as you're not in a state that has its ain punishment for people who go without minimum essential coverage, you're complimentary to buy a programme that's not compliant with the ACA, and y'all won't be penalized for doing so. Simply your coverage won't be anywhere near a solid as information technology would be nether an ACA-compliant programme. If you lot stay healthy, you'll be fine. But if you finish upward needing extensive medical care, your non-ACA-compliant plan could exit you on the hook for substantial medical bills.

Is a grandmothered or grandfathered plan ACA-compliant?

If yous've got coverage under a pre-ACA plan (a grandmothered or grandfathered plan), information technology's likely not compliant with the ACA. Simply it is considered minimum essential coverage – then it will fulfill a land-based private mandate and you won't exist field of study to a penalty.

Information technology's in your all-time interest, however, to make sure you advisedly compare it with the ACA-compliant plans that are bachelor for purchase during open enrollment or when your existing plan is up for renewal, or during the COVID-related enrollment period that continues through August fifteen, 2021 in most states. And even if you looked a few years ago and weren't eligible for premium subsidies, you may be subsidy-eligible now.

This is always a possibility due to yearly increases in the poverty level (for 2014 coverage, a family unit of four could only earn up to $94,200 to be subsidy-eligible; for 2020, that corporeality had increased to $103,000), just the American Rescue Programme's substantial enhancement of premium subsidies for 2021 and 2022 ways that coverage is much more affordable than it would normally be. And there is no income cap for subsidy eligibility in 2021 and 2022; instead, people who earn more than 400% of the poverty level can still authorize for a subsidy if the benchmark plan would otherwise cost more 8.five% of their ACA-specific modified adjusted gross income.

Louise Norris is an individual wellness insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces virtually the Affordable Care Human activity for healthinsurance.org. Her state health commutation updates are regularly cited by media who cover health reform and by other health insurance experts.

Source: https://www.healthinsurance.org/faqs/what-happens-if-i-dont-buy-aca-compliant-health-insurance/

0 Response to "what if i need to file a medical claim between end of coverage and cobra"

Post a Comment